This article is part of the LatAm Tech Weekly Series, written by Julia De Luca and powered by Nasdaq. Through Nasdaq’s global network, we partner with Latin American companies to support their entire business lifecycle to elevate their brand and access the global markets. Learn more about Latin American Listings here.

Wow, can you believe it’s already December? The year has flown by! We’ve got a ton to unpack this week, so let’s dive right in. Latitud just dropped their LatAm Tech Report for 2023, Kamaroopin wrapped up their annual event, Female Force got together at Google, and Amazon rocked their AWS Reinvent conference. It goes without saying that the world suffered losses this week with the passing of Henry Kissinger and Charlie Munger.

Thanks for reading! Subscribe for free to receive new posts and support my work.

Follow me on LinkedIn , Instagram or Twitter for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

2023 turned out to be a year where founders had to stretch every dollar. Latitud sums it up perfectly: entrepreneurs are ending this year not just stronger, but also smarter. I highly recommend checking out their full report (yes, all 285 slides of it), but for now, I’ll highlight the key takeaways. The report kicks off with an overview of the current state of the startup scene in LatAm, then zeroes in on the future of seven key sectors: fintech, e-commerce, logistics, SaaS, proptech, edtech, and healthtech. Here are the core questions each section tackles:

1. What’s the current scenario?

2. What trends are shaking things up, and how are startups capitalizing on them?

3. What opportunities are emerging?

4. What hurdles are these sectors facing?

Let’s start with the basics. It’s no surprise to my regular readers that VC investment in Latin America dropped this year. But here’s something that’s buzzing: AI. It’s still a work in progress in LatAm, yet a whopping 63.22% of startups are integrating AI into their operations in some form, impacting their businesses from marginally to significantly. Investors echo this, observing widespread AI adoption in their portfolios.

Fintech, my personal favorite and arguably LatAm’s most mature startup sector, captured about 40% of all regional venture capital in 2023. The pandemic pushed consumers and financial services online, but there’s still a long road ahead. After the initial surge in banking fintechs and the groundwork laid by software fintechs, the focus is now on lending and payment solutions. They’re tackling crucial issues like limited credit access and high rates of payment rejections.

Despite a drop in the number of new VC-backed fintechs, significant late-stage funding rounds are making a comeback. For instance, Nomad bagged a cool $61M in August, and QI Tech secured a hefty $200M in October.

Merging my two interests, AI in fintech ranges from customer service enhancements to sophisticated credit scoring. In line with other sectors, fintechs are leveraging AI, particularly large language models (LLMs) and natural language processing (NLP), to develop chatbots. These aren’t just any chatbots; they guide customers from discovery to post-sale support, including payment follow-ups and personal info updates. For example, Blip’s NLP-powered chatbots are a hit with major Brazilian banks like Itaú.

Looking ahead, insurtech is poised to be the next big thing in fintech.

Challenges facing the sector:

-

High capital costs

-

Intense B2C competition and customer acquisition costs

-

Data privacy and security concerns

-

Trust and regulatory hurdles for digital currencies

-

Open finance acceptance, regulation, and viable business models

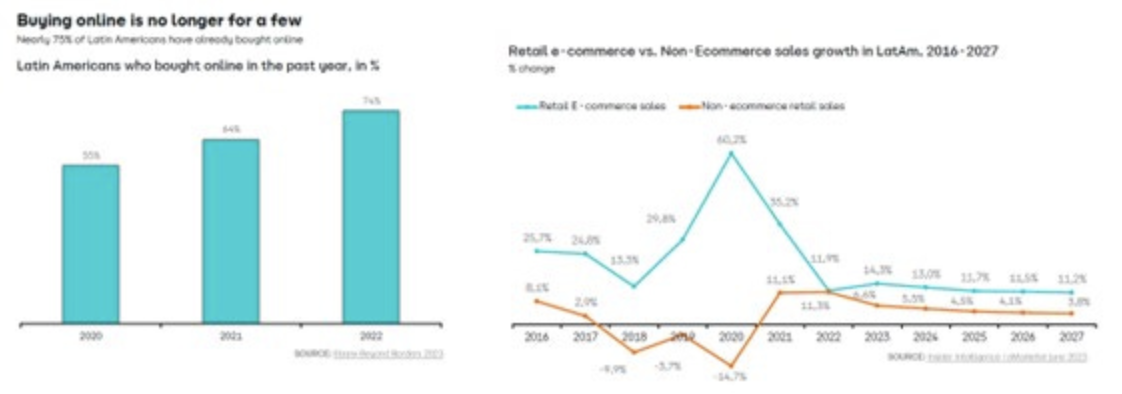

E-commerce is up next. After the explosive growth in 2020 and 2021, three-quarters of Latin Americans have shopped online, spanning all age groups. However, growth rates are expected to slow down from 2023, given this new baseline. With consumers returning to brick-and-mortar stores, we’re also seeing a dip in traditional retail growth rates.

Mobile commerce has been fueling e-commerce growth in the region since 2021, now making up the majority of the sector’s transaction value. By 2026, it’s projected to account for 63% of all e-commerce transactions in LatAm, with a CAGR of 16% from 2018-2026. That’s double the rate for desktop e-commerce. Interestingly, LatAm’s mobile commerce share outstrips that of the US, UK, and some EU countries, though there’s still room to grow, as seen in countries like India and China.

E-commerce in LatAm is dominated by big players like Mercado Libre and Amazon. In Brazil, the top five online retailers control 51% of the market; in Mexico, it’s 66%. The real growth opportunity lies in bringing more small and medium businesses (SMBs) online. SMBs in LatAm are huge job creators, yet they contribute less to the regional GDP compared to their US counterparts.

E-commerce challenges:

-

Data management and organization

-

Shrinking margins and the elusive path to profitability

-

Macro-economic factors

-

Network quality issues

-

Regulatory and tax complexities, especially for cross-border transactions

Trend watch:

-

The rise of hybrid work

-

AI-driven customer experience and productivity boosts

-

Niche vertical growth in SaaS

-

Global expansion strategies for SaaS startups

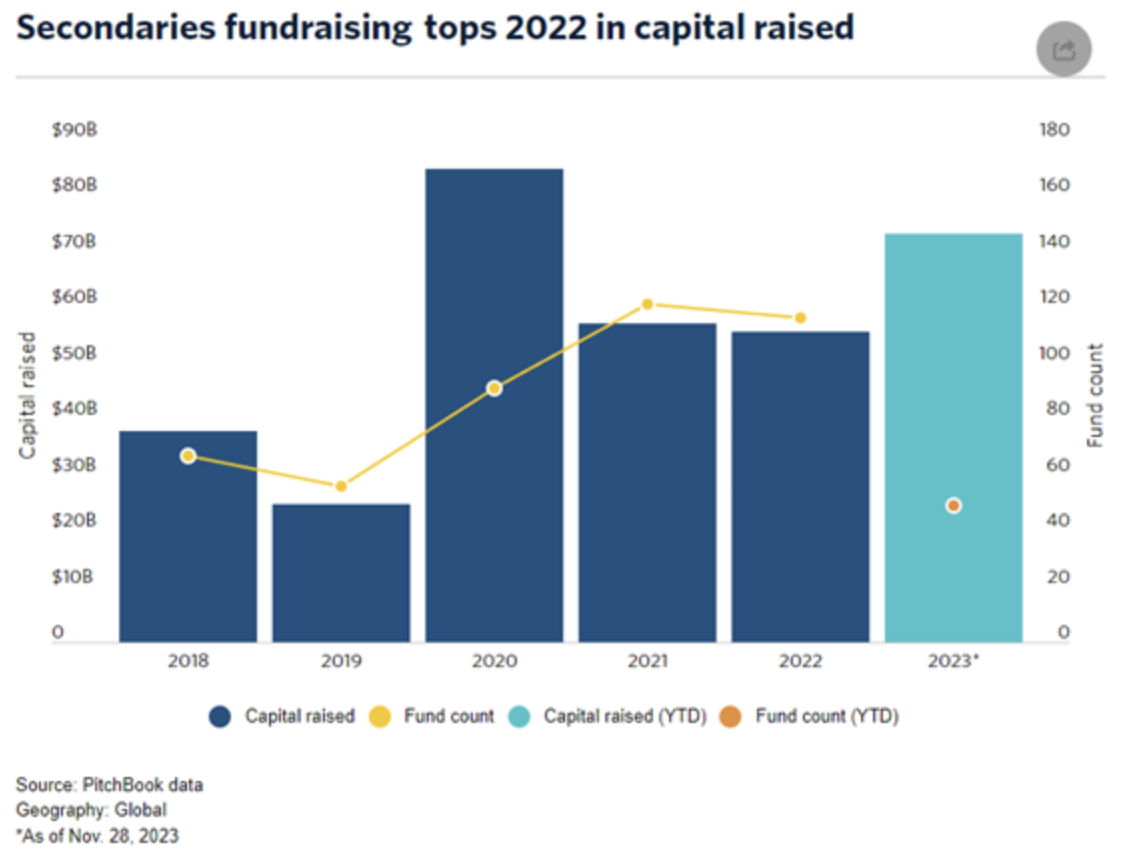

Shifting gears, Pitchbook recently shared an insightful study on secondary fund closes in 2023. In my ongoing chats with investors, a hot topic is the exit landscape in LatAm. Secondary funds might just be the answer for early-stage venture funds. For instance, Pantheon recently closed its largest-ever secondaries fund at $3.25 billion.

With traditional exit paths narrowing, LPs and GPs are increasingly turning to secondary transactions for liquidity. Pantheon’s move suggests private wealth clients are eager to get in on the action.

Looking forward, venture investors are gearing up for a rebound in 2024. Half of the respondents in a industry survey conducted by Pitchbook are expecting an uptick in dealmaking. But it’s not all roses and rainbows; profitability remains a key investment criterion.

Pitchbook’s latest Emerging Tech Research delves into investor sentiments on tech and the overall VC market, noting shifts over the year. A couple of quick takes: Generative AI is still hot, but crypto might be overhyped. As for fund returns, 2024 is shaping up to be a standout year.

That’s all for now! Let’s keep an eye on these trends as we step into the new year.

Monday

General news:

-

The Brazilian Central Bank’s digital currency, Drex, has successfully completed over 700 transactions in tests, with blockchain platform Hyperledger Besu processing over 1.283 million blocks. The entity also plans to update Drex and Pix to function offline, aiming to enhance financial inclusivity for areas without reliable internet access.

-

Itaú Unibanco’s Íon app introduced a ‘portfolio diagnosis’ feature, providing a rating system for clients’ investment portfolios. This tool helps clients align their portfolios with their investment profiles and expected risk returns and offers easy adjustment options within the app. .

-

Locaweb reported strong Black Friday sales, contributing to a positive outlook for the holiday season. The company updated its 2023 estimates to reflect a 17% year-over-year growth in ecosystem Gross Merchandise Value (GMV) for Q4 2023, emphasizing the relevance of ecosystem GMV over platform GMV

-

BV Bank, in collaboration with Senai-Cimatec, is advancing in quantum computing simulations to solve complex financial sector problems, focusing on credit, data, and information security.

-

Black Friday sales in Brazil were the second worst since the event’s inception in 2010, with a 14.4% decrease in sales compared to the previous year, totaling R$ 4.5 billion.

-

The global cryptocurrency platform OKX, ranked second in trading volume, officially commenced operations in Brazil. It offers a transaction app, digital wallet, and products/services tailored for the Brazilian market.

Deals:

-

Destaxa raised $6.09M in Early Stage VC funding, led by Astella Investimentos. The company develops payment software that optimizes transaction fees by selecting the lowest-cost acquirers, with investors including Caravela Capital, Endeavor Promessas, Quona Capital, and Supera Capital.

-

BomConsórcio, a fintech in the secondary consignment market, raised R$ 96.1 million from its third FIDC issuance. The funding supports the company’s competitive solutions for consignment participants and administrators. BomConsórcio has facilitated approximately R$ 600 million in transactions across more than 50,000 operations.

-

Cubo raised USD$3.5 million round and arrives in Guatemala. Cubo connects with more than 10,000 companies in Central America, 40% of which are run by women, which fulfills Cubo’s goal of achieving regional financial and technological inclusion.

-

SHEIN has filed confidential paperwork for its initial public offering with the US securities regulator. The IPO decision comes a year after Shein raised cash at a vastly reduced valuation of approximately $66bn from $100bn

Tuesday

General news:

-

Latin American venture capital firm NXTP successfully closed its third fund, amassing $98 million. This fund is dedicated to investing in early-stage B2B startups, highlighting NXTP’s focus on fostering emerging business-to-business enterprises in the region.

-

Clara launches a new account product and aims beyond cards. The new product is called Clara Account, and it now enables the management and execution of payments through bank transfers (DOC, TED), and in the future, Pix as well.

-

InDrive launches a $100M fund with a focus on social impact startups. The initiative is geared towards seed or pre-Series A stage startups, with Brazil being one of its top priorities

Deals:

-

Livance, a developer of a space-as-a-service platform aimed at revolutionizing medical offices, raised $13.2 million in Later Stage VC funding. The funding round was led by Monashees, with participation from Cadonau Investimentos and Terracotta Ventures.

Wednesday

General news:

-

Latin American fintechs are showing an increased interest in serving small and medium enterprises (SMEs) by 2024. Brazil and Mexico lead in the number of fintechs focusing on SMEs, followed by Colombia and Argentina.

-

Mexico has experienced a 41% decrease in venture capital transactions up to October 2023. A total of 81 venture capital deals amounting to $668 million were recorded, indicating a significant slowdown in the venture capital activity in the country.

-

Sequoia Capital has completed the separation of its IT systems and back-end functions like finance and accounting from its Chinese and Indian entities, formerly known as Sequoia Capital China and Sequoia Capital India.

-

Lenovo to spend USD$15million on AI only in Latin America. The initiative, already implemented in other parts of the world such as Europe, North America, and Asia-Pacific, has had a third of its 70 participants in the United States.

Deals:

-

Meddi, a Mexican startup, attracts a $1.7 million investment to boost healthcare in LatAm. The Mexican startup Meddi secured $1.7 million in seed investment, led by Medical Device Resources LTD, to expand its healthcare and wellness services in Latin America.

-

Fintech DiiMO closes a $1.2 million investment to drive financial inclusion in Central America. El Salvador’s fintech, DiiMO, is promoting financial inclusion in Central America with a successful Pre-Series A financing round.

Thursday

General news:

-

Kamaroopin held its 2023 Investor Day (more information on the “What did I learn from readers” section.)

-

Zup, a Brazilian software and digital transformation solutions company, has launched an AI platform for code generation, marking a significant step in its internationalization strategy. With this development, Zup aims to accelerate its presence in the U.S. market.

-

Vórtx, a fintech specializing in fund administration and market infrastructure, collaborated with Mercado Bitcoin to create a crypto trading platform targeted at institutional investors. This platform allows managers to invest in digital assets directly from Brazil and in Brazilian reais.

-

Brazilian FitBank has processed about R$ 64 billion in the 12 months leading up to September 2023, growing by 600%. Specializing in Banking as a Service (BaaS) and Real Time Payments, FitBank reported a net profit of R$ 7.4 million in the first half of the year. BaaS allows companies to offer financial services aligned with their business strategies.

-

Nuvini and Semantix join forces to develop AI. With the partnership, Semantix’s AI team will enhance and optimize operations across Nuvini’s portfolio of companies.

Deals:

-

BRQ Digital Solutions, an information technology service provider, announces another strategic investment through its Innovation Hub. The company has invested $200,000 (approximately R$1 million) for a 4% stake in Kobana, a startup focused on open finance that automates the financial processes of businesses.

-

Zubale raises USD$25 million to consolidate in Mexico and Brazil. Over the past two years, it has experienced a threefold year-over-year growth in net revenues, following a successful Series A that raised USD$40 million in 2021.

Friday

Deals:

-

Totvs completes a R$380 million M&A deal, strengthening its portfolio in the HR sector. In its fifth and largest acquisition of the year, Totvs has announced an agreement to acquire Ahgora, a Santa Catarina-based company specializing in software for human resources departments.

-

Kaszek led a seed round in Brinta, a Uruguayan startup founded this year that has already expanded its regional operations, including the Brazilian market. The round raised USD$5 million. Brinta’s business is to facilitate and streamline tax compliance, explaining its expansion in the complex Latin American landscape.

What did I learn from readers?

Below you can find the main highlights from Kamaroopin’s Investor Day.

-

Portfolio and Investment Duration: KMP Growth Fund II has invested over 30% in companies like dr.consulta, ZenKlub + Conexa, and Consorciei, and expects a shorter investment cycle compared to other growth funds.

-

International Expansion: KMP plans to diversify with investments in Latin America, including 1 or 2 new ventures.

-

Investment Strategy: Increasing investment criteria to filter opportunities and considering partnerships with co-investors.

-

ESG Focus: Emphasizing ESG (Environmental, Social, and Governance) as a competitive strategy rather than just a differentiator.

-

Fundamental Investment Pillars: Quality of partners and close management relationships; main factors include longevity, growth, and governance.

-

Emerging Market Trends: Notable shift in investment focus from China to India, and now to Brazil, especially in the Private Equity market.

-

Specific Company Insights:

-

Petlove: Impressive growth in the petcare sector, transitioning from retail to a holistic pet health ecosystem.

-

ZenKlub: Over 40% CAGR since 2020, focusing on mental health and telemedicine.

-

ZenKlub + Conexa: Becoming Latin America’s largest digital health platform, emphasizing comprehensive health care.

-

dr.consulta: Targeting mid/low public with a focus on technology and telemedicine.

-

Consorciei: Exploring opportunities in the consorcio market with innovative service models.

-

-

Thematic Investment Theses:

-

Climate Change: Addressing it as a crucial problem and investment opportunity, particularly in energy and sustainable agriculture.

-

Embedded Finance: Leveraging software to distribute financial products.

-

Pet Sector: Capitalizing on the trend of humanizing pets.

-

Health Sector: Addressing the growing healthcare needs, focusing on efficiencies and integrated models.

-

What am I reading?

What am I listening to? What am I watching?

Quote of the week:

In honor of..

“The task of the leader is to get people from where they are to where they have not been.” Henry Kissinger

“I never allow myself to hold an opinion on anything that I don’t know the other side’s argument better than they do.” Charlie Munger

Originally published on my Substack.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.